reverse sales tax calculator ontario

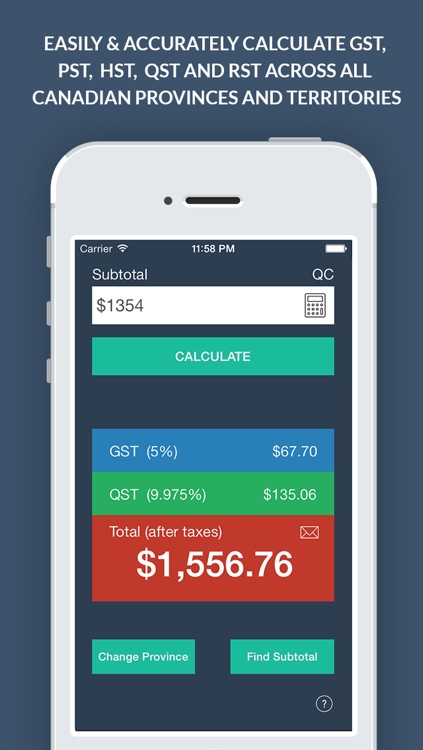

Northwest Territories Nunavut and Yukon have no territorial sales tax at all. This app is especially useful to all manner of professionals who remit taxes to government agencies.

Tactică Orice Ashley Furman Canadian Sales Tax Calculator Spaziocontatto Net

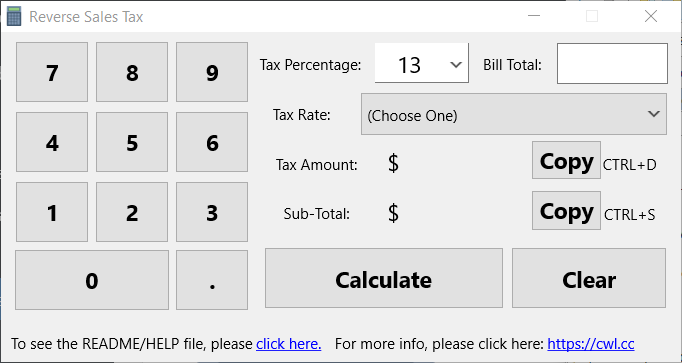

Reverse Sales Tax Calculator.

. Total Price is the final amount paid including sales tax. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. You can use this method to find the original price of an item after a.

HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. This is very simple HST calculator for Ontario province. Graphing Calculator Online Free Download.

Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. 13 for Ontario 15 for others If you want a reverse HST calculator the above tool will do the trick. New Brunswick Newfoundland and Labrador Nova Scotia Ontario Prince Edward Island HST Tax Rate.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. Scroll down to use it online or watch the video demonstration. Any input field can be used.

Net Sale Amount Total Sale 1 sale tax rate 105000 105 100000. This rate is the same since july 1st 2010. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

Enter price without HST HST value and price including HST will be calculated. Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage. Reverse Sales Tax Formula.

Also is a tool for reverse sales tax calculation. Sale Tax total sale net sale 105000 100000 5000. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount.

Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. It is very easy to use it. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax.

Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and. As we can see the sale tax amount equal to 5000 which the same to above calculation. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

Instead of using the reverse sales tax calculator you can compute this manually. You have a total price with HST included and want to find out a price without Harmonized Sales Tax. GSTHST provincial rates table.

Formulas to Calculate Reverse Sales Tax. The rate you will charge depends on different factors see. Single Premium Immediate Annuity Calculator.

Current Provincial Sales Tax PST rates are. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. The period reference is from january 1st 2021 to december 31 2021.

Newfoundland and labrador income tax calculator. Current HST rate for Ontario in 2022. Reverse Sales Tax Calculator.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Provincial federal and harmonized taxes are automatically calculated for the province selected.

Enter the sales tax percentage. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. The reverse sales tax formula below shows you how to calculate reverse sales tax.

Provinces and Territories with HST. Type of supply learn about what supplies are taxable or not. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value. Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018. Most states and local governments collect sales tax on items that.

Sales tax calculator 2021 for ontario. Enter HST value and get HST inclusive and HST exclusive prices. The HST was adopted in Ontario on July 1st 2010.

No change on the HST rate as been made for Ontario in 2022. Net Price is the tag price or list price before any sales taxes are applied. The reverse sale tax will be calculated as following.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13. For State Use and Local Taxes use State and Local Sales Tax Calculator.

Reverse Sales Tax Calculator. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. The harmonized sales tax or hst is a sales tax that is applied to most goods and services in a number of canadian provinces.

The following table provides the GST and HST provincial rates since July 1 2010. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. This free calculator is handy for determining sales taxes in Canada. Reverse GST HST PST QST Calculator 2022.

Not all products are taxed at the same rate or even taxed at all in a given. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. To find the original price of an item you need this formula.

This simple PST calculator will help to calculate PST or reverse PST. Who the supply is made to to learn. Calculates the canada reverse sales taxes HST GST and PST.

An 8 provincial sales tax and a 5 federal. It ranges from 13 in Ontario to 15 in other provinces and is composed of a provincial tax and a. Sales Tax Calculator Omni Calculator.

Calculate a simple single sales tax and a total based on the entered tax percentage. The HST is made up of two components. The reverse sales tax calculator exactly as you see it above is 100 backtrack time calculator.

The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST. Reverse Sales Tax Calculator. That entry would be 0775 for the percentage.

Where the supply is made learn about the place of supply rules. Need to calculate sales tax in Canada. Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals.

Ontario HST calculator 2020. So if you push temp onto results without How do I calculate sales tax in Ontario.

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Sales Tax Calculator 100 Free Calculators Io

Canadian Sales Tax Calculator By Fascinative

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Alberta Gst Calculator Gstcalculator Ca

Manitoba Gst Calculator Gstcalculator Ca

Reverse Hst Calculator Hstcalculator Ca

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Pst Calculator Calculatorscanada Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Washington Dc Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Canada Sales Tax Gst Hst Calculator Wowa Ca

Canadian Sales Tax Calculator By Fascinative