how to reduce taxable income for high earners australia

The amount youre allowed to contribute depends on your income. 6000 NOI - 3636 depreciation expense 2364 taxable income.

8 Ways On How To Reduce Taxable Income For Individuals In Australia Box Advisory Services

Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win.

. Maximizing all of your. The more you earn the more invested youre likely to be in making sure that. With a daf you can make a donation receive an immediate tax deduction and then recommend grants to be given from.

Use charitable trusts and other deductions. If you are an employee. Our extensive amount of experience and.

Your annual tax payable can be reduced by pre-paying some of your tax-deductible expenses such as prepaying the interest on an investment loan. Invest in municipal bonds. New tax legislation made small reductions to income tax rates for many individual tax brackets.

To reduce your taxes you can make the following concessionary contributions. Here are 9 ways to accomplish your goal and reduce your tax bill. How do high-income earners reduce taxes in Australia.

Set up a Donor-Advised Fund. Always talk to a good Financial. Salary sacrificing Personal deductible contributions There is no income tax limit on salary.

A Way to Decrease Your Taxable Income Donating to a DRG organization is one approach to lower the amount of your income that is subject to taxation. You can contribute up to 6000 per year if youre under 50 years old and up to 7000 if youre 50 or. How To Reduce Taxable Income For High Earners 2020.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The easiest way to reduce CGT for high-income earners is by holding onto an asset for at least 12 months which reduces the assessable capital gain by 50 and reduces the overall tax payable. Max Out Your Retirement Contributions Lets start with retirement accounts.

At Valles Accountants we have worked with countless high income earners to effectively reduce their tax through a variety of different methods. 50 Best Ways to Reduce Taxes for High Income Earners 1. But the tax changes are only temporary and increased the standard deduction for.

If youre a high-income earner in Australia it is wise to implement a tax minimization strategy. Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super. If you can manage your taxable income by fully maximising your tax deductions or.

Superannuation contribution options to reduce taxes. Youd have to contribute 5000 of money into super but it would save you 2350 in tax by doing so if you were paying 49 tax on your salary. 401 k or 403 b.

Donating to Charity. A common offset is the Low Income Tax Offset and the Low and Middle Income Tax Offset. However what the IRS gives they also take back when you sell the property by recapturing the depreciation.

If you can pay some of your.

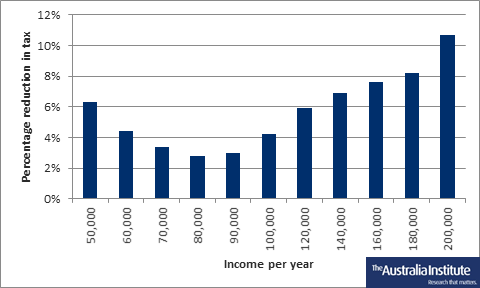

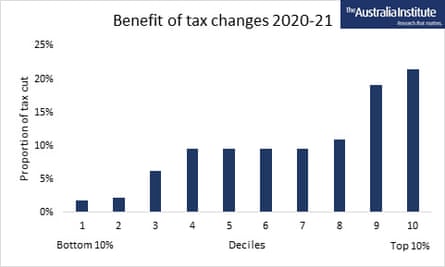

The Whole Of The Government S Income Tax Plan Has Passed The Parliament So What Does That Mean By The Australia Institute Medium

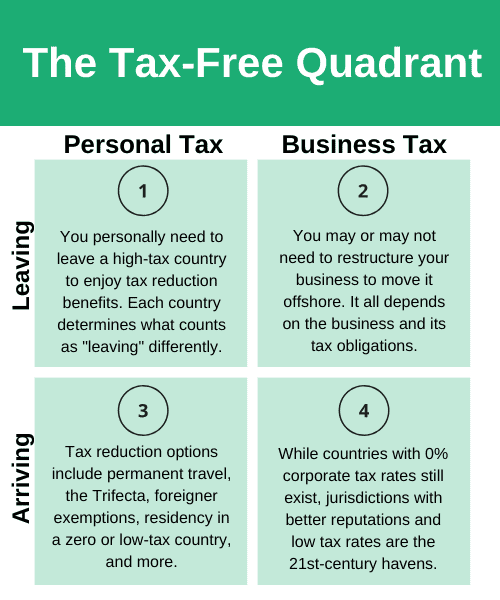

Entrepreneurs Here S How To Pay Less Taxes

Marginal Tax Rates On Labor Income In The U S After The 2017 Tax Law

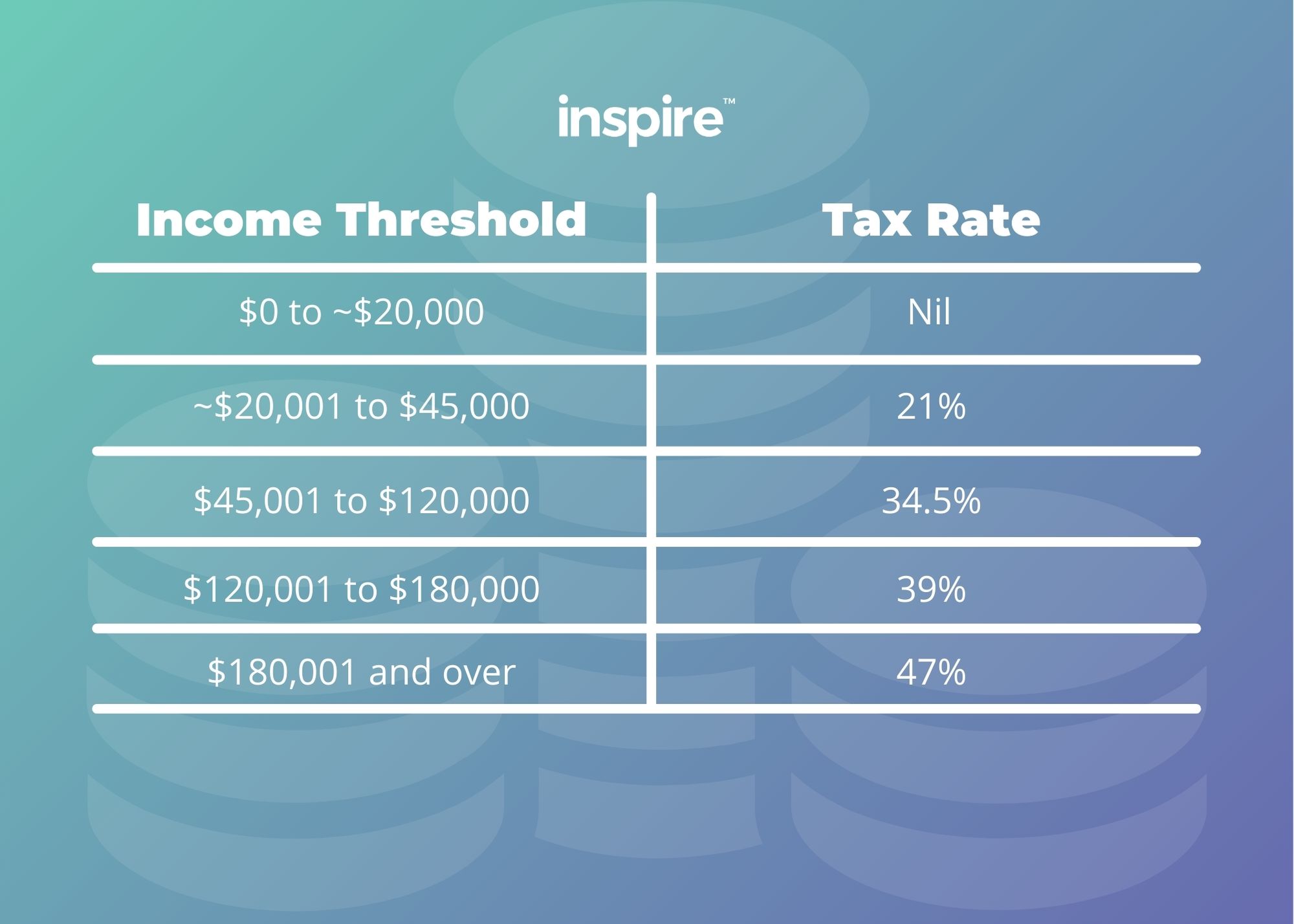

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

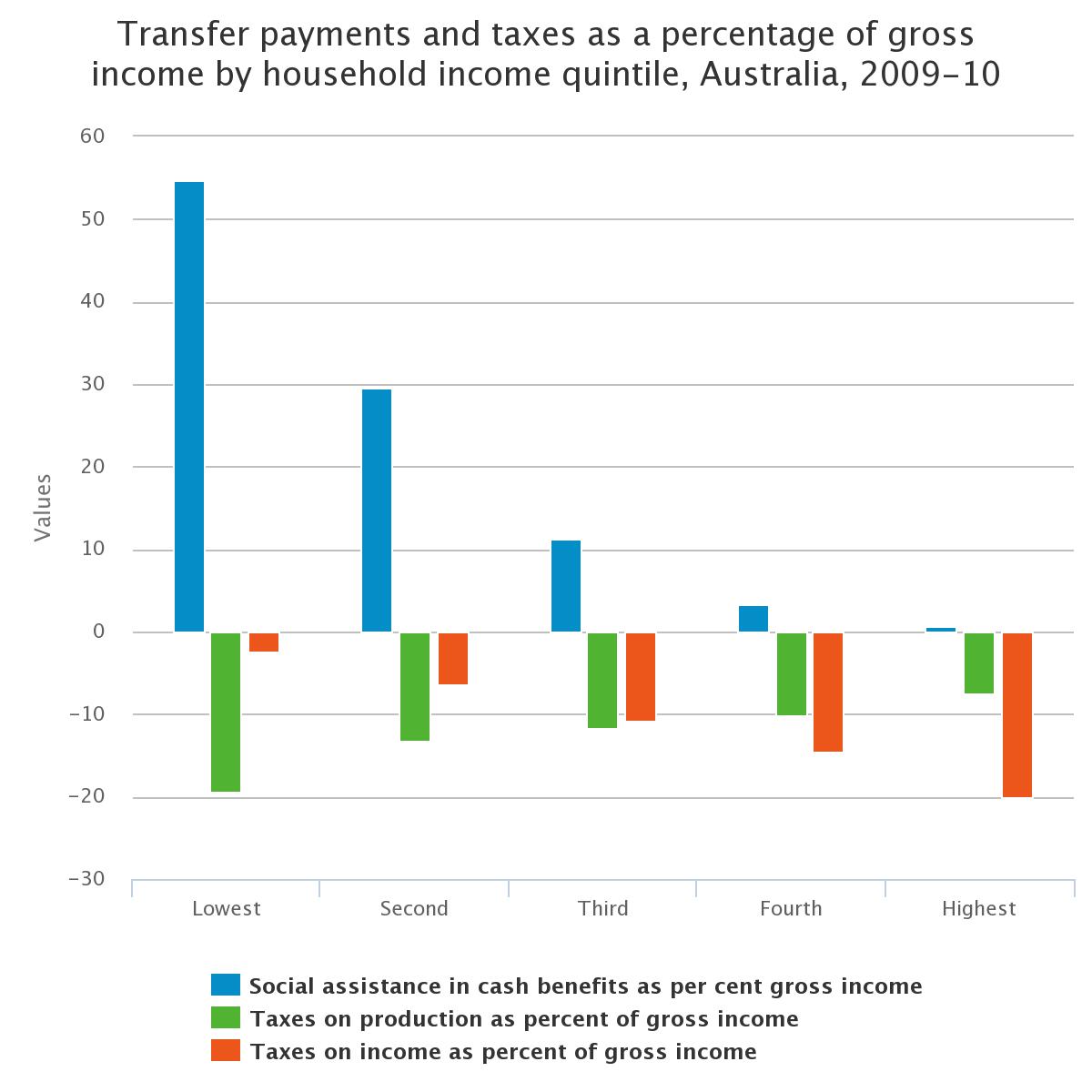

How Raising Tax For High Income Earners Would Reduce Inequality Improve Social Welfare In New Zealand

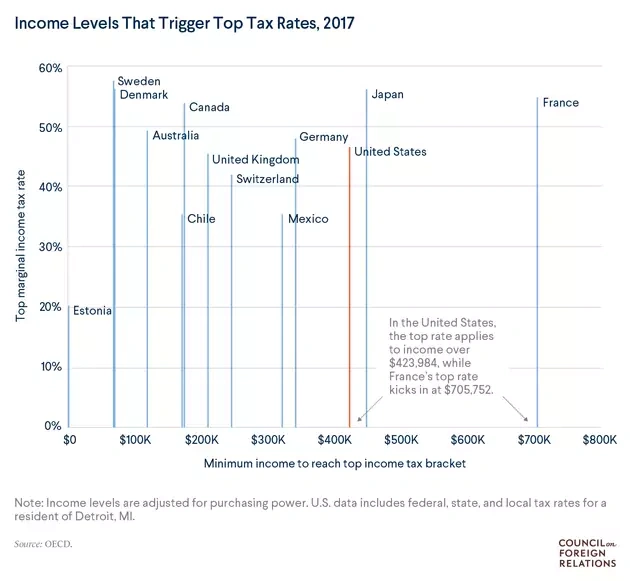

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Tax Reduction Strategies For High Income Earners 2022

High Income Earners To Reap 88 Of Coalition S Tax Cuts By 2021 22 Australian Economy The Guardian

How Do High Income Earners Reduce Tax In Australia Imagine Accounting

Reduce Your Taxable Income Save More Money Clever Girl Finance

Fifteen Ways To Reduce Your Tax Bill Financial Times

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Double Taxation Of Corporate Income In The United States And The Oecd

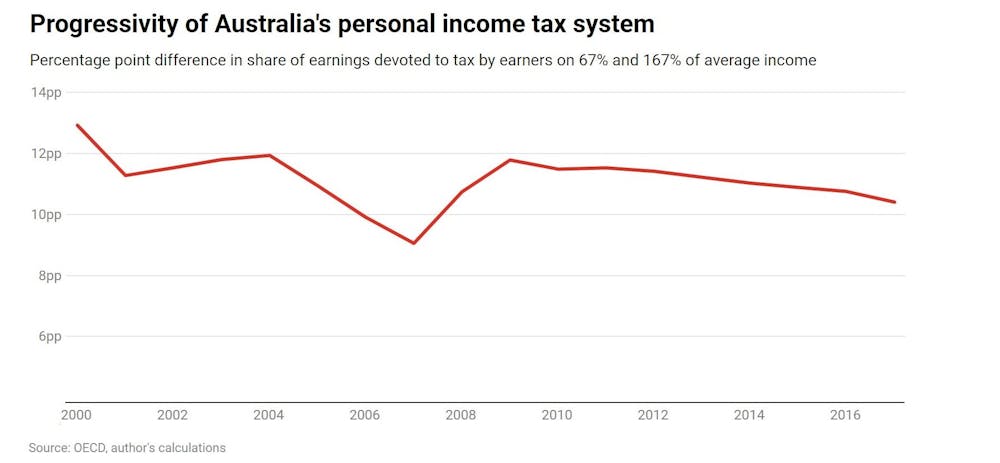

Fairness Isn T Optional How To Design A Tax System That Works

In Tax Gender Blind Is Not Gender Neutral Why Tax Policy Responses To Covid 19 Must Consider Women Ecoscope